Assessor's Office

Assessor Information:

The Assessor is jointly appointed by the City Manager and City Council. The Assessor's Office is responsible for the assessment of all properties and the computation of all data necessary and appropriate to such assessment. The Assessor's constitutional mandate is to apportion and assess the property tax burden among all property owners fairly and equitably, "according to the just value thereof" (Maine Constitution, Article IX § 8).

The Assessor's Office is responsible for the following:

- Manage the City's tax assessment program, including property, personal property and business equipment, maintain records related to assessment of properties and provide the opportunity for the public to review such records

- Answer questions about state property tax exemptions, refunds and laws.

- Create and maintain the City's annual tax commitment, tax rolls, listings of City-owned property, exempt property and tax maps.

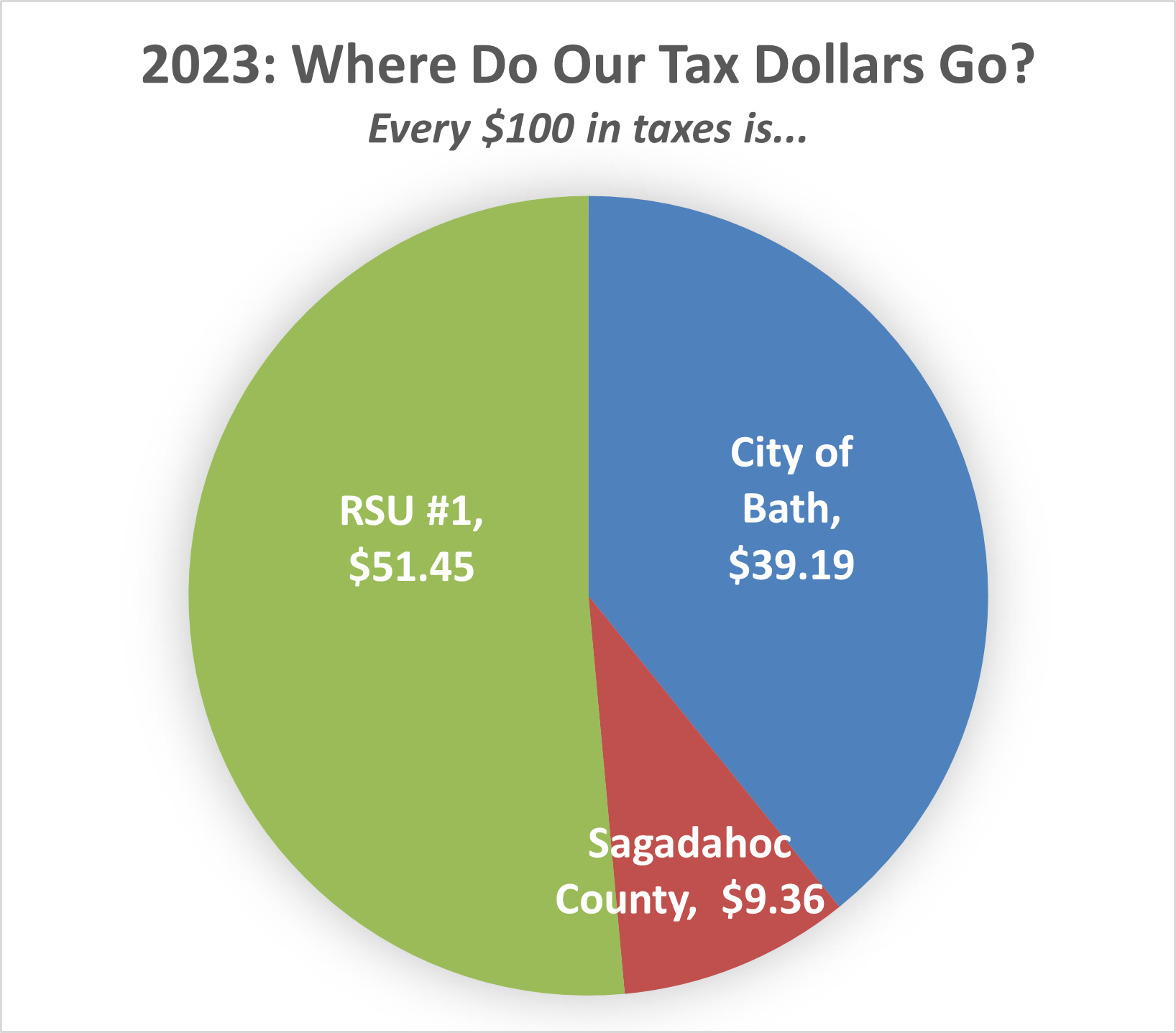

Tax Information:

| Tax Rate (Per $1,000) | $16.90 |

| Tax Year | July 1 - June 30 |

| Certified Assessment to Sale Ratio | 100% |

| Tax Bills Sent | 2nd Week in September |

| Due Date | October 16 |

| 2023 Tax Commitment | August 28, 2023 |

More information on the 2023 commitment can be found on the commitment files page. Property tax bills are also posted on our web page. The Property Record Cards for all Bath properties are available on our website and from the online assessor's database.

Property Tax Relief

Rapidly rising residential property values have the effect of shifting more of the property tax burden to residential property taxpayers, who in 2023 contributed 58% of the total property tax revenue raised in the City of Bath. In response, the State of Maine has expanded access to two important programs for property tax relief: the Property Tax Fairness Credit and the Property Tax Deferral loan program. You can find more information on these programs on our webpage.

2023 Valuation Update Information:

In 2023, we updated 2019 property values to ensure the City's real property remains, on average, valued for tax purposes at or near 100% of its market valuation. Without such an update, State of Maine reimbursements to the City for various property tax exemptions would have been reduced by 22%, and homestead exemptions would have been reduced in value to $19,250. In 2022, Bath received nearly $3.1 million in State reimbursements for property tax exemptions; a reduction in reimbursement would lead to property tax increases for all Bath taxpayers. This update is based on our 2019 full city-wide revaluation (as of 4/1/2019). For a summary of the 2019 revaluation please see the 2019 Revaluation Summary page.

For information on the valuation update, including a full report on the 2023 valuation changes, see our 2023 Valuations page. You can also make an appointment online to review your valuation with the assessor.

For more information on Bath's assessments and valuations from year to year, see our Assessing History page.